.jpg?2026-02-17T14:47:30.411Z)

When Leroy Merlin ran out of hands, InAppStory became the extra ones

.jpg?2025-12-03T08:06:19.063Z)

-1.jpg?2025-12-03T08:09:46.854Z)

.jpg?2025-12-03T08:10:45.802Z)

How Leroy Merlin Scales Stories Across Three Markets

Karina

Author @ InAppStory

Our previous case proved that stories transformed Leroy Merlin’s app from a static catalog into a dynamic, visual interface. This new study moves beyond global results and explores a deeper question: How does one format behave across different e-commerce cultures when local teams shape it around local needs?

TL;DR

Leroy Merlin uses stories as a flexible engagement layer across several European markets. Our analysis covers France, Poland and Italy and includes nine datasets, real interaction metrics, visual patterns and story structures.

Key findings:

- France uses stories as an editorial and service-explanation format. It shows 30–69% read rates, stable multi-slide completion and thoughtful click behavior that correlates with slide sequencing.

- Poland uses stories as a performance surface. Short story flows and direct value prompts deliver the highest CTR across all markets and the fastest user actions.

- Italy adopts a mood-driven discovery model. Short seasonal and catalog stories perform well through atmosphere, clean layout and mid-sequence product framing.

Across all markets, stories improve e-commerce UX by guiding navigation, reducing cognitive load in complex categories, structuring seasonal content and expanding the reach of promotions beyond static banners.

France: Editorial Structure and Service Clarity

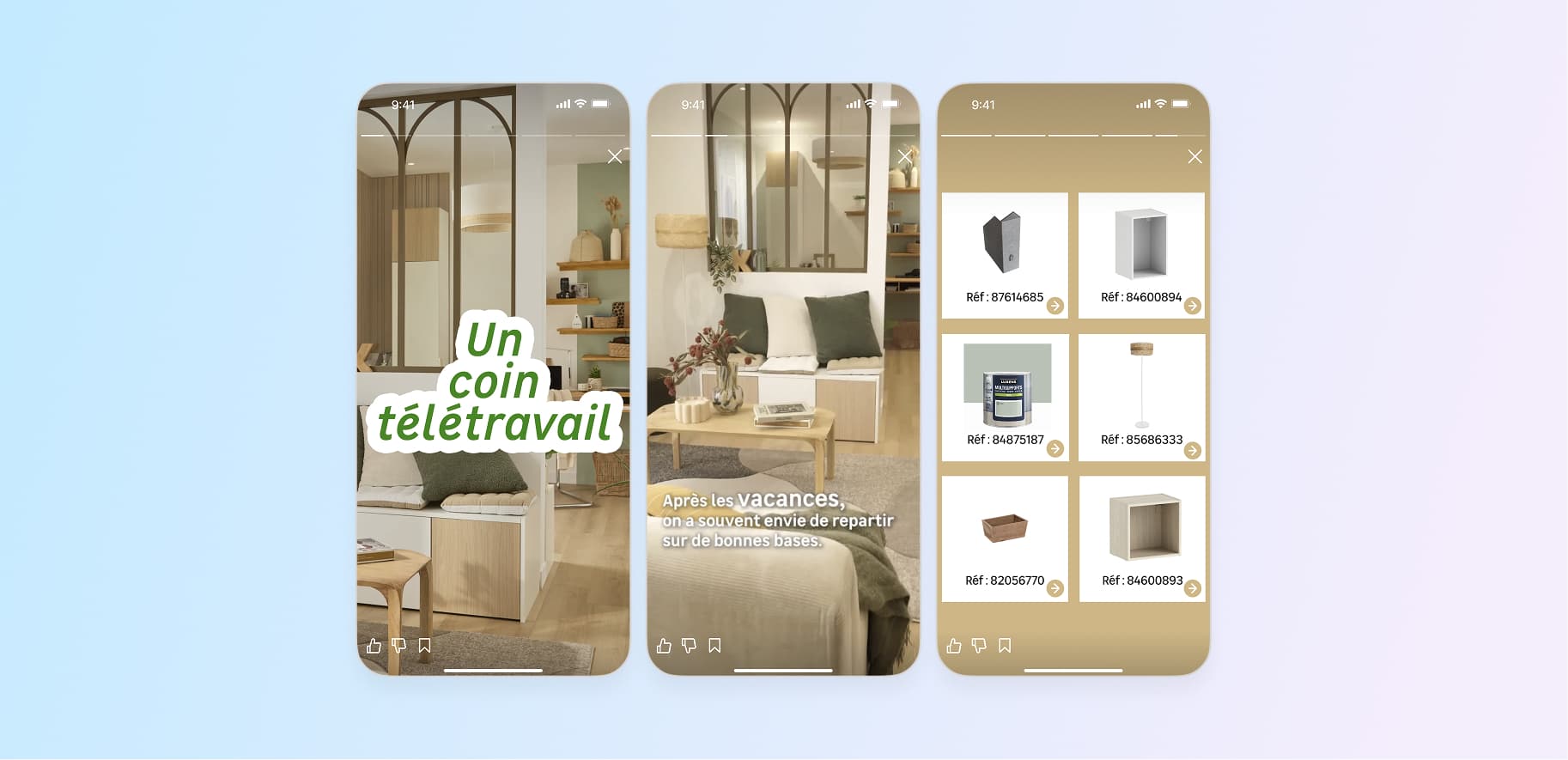

France demonstrates the most structured and editorial approach to stories. Local teams use an internal content taxonomy consisting of:

- Inspiration (trend boards, aesthetic themes, seasonal mood)

- Services (installation, project support)

- Utility (loyalty, program changes, value messaging)

This segmentation matches the behavior of French users, who expect clarity, sequence and reasoning before action.

French stories follow a consistent internal rhythm:

- Slide 1 — Framing

A soft entry point that sets context. Low text density, warm tone. - Slide 2 — Core message

Clear statement of service, trend or benefit. Often the slide with the highest attention stability. - Slide 3 — Supporting detail

Breakdown of what is included (for services) or key aesthetic elements (for inspiration). - Slide 4 — Advantages or value

Guarantees, price transparency, loyalty mechanics, curated product combinations. - Slide 5 — CTA

A single action, typically “discover” rather than “buy”.

This structure reduces friction and creates a linear interpretation path. It is well aligned with a market that favors comprehension over speed.

Service Stories

Service journeys require more cognitive effort than simple product interactions. Slides with detailed explanations lower perceived complexity and allow the user to absorb information progressively.

Metrics across datasets:

- Read rate: typically 30–35%

- CTR: 0.49–0.9%

- Post-read CTR: consistently above 12–15%

What this means for e-commerce UX: Retailers often struggle to present services inside an interface optimised for products. Stories provide a linear flow where each component of a service (removal, plumbing, tiling, guarantees) gets the necessary space. Users progress through the explanation without feeling overwhelmed.

.jpg?2025-12-02T17:18:14.250Z)

Inspiration Stories

These stories work as visual mini-editorials. They highlight colour palettes, texture families and seasonal trends.

.jpg?2025-12-02T15:29:11.162Z)

Metrics:

- Read rate: 40–55%

- CTR: moderate, evenly distributed across product tags

- Slide count: typically 3–4

Aesthetic density drives attention, while the short format keeps the story consumable. Users often treat these stories as entry points into category exploration rather than direct product funnels.

E-commerce relevance: This model bridges the gap between lifestyle content and product discovery. It replaces static inspirational sections with dynamic, timely visuals that appear exactly when user interest is highest.

Loyalty Stories

This category shows the strongest French engagement.

.jpg?2025-12-02T15:35:01.196Z)

Patterns:

- The first slide often uses a question to trigger curiosity.

- Middle slides outline benefits with transparent language.

- Final slide consolidates the value and leads to the program.

Metrics:

- Read rate: 45–69%

- CTR: 1.31–1.85%

- Peak CTR: 7.08% (segment-narrowed audience)

- Slide count: 5

These numbers indicate high trust and clear comprehension. In loyalty communication, comprehension is a more important metric than raw CTR, and stories provide a controlled environment for that.

E-commerce relevance: Loyalty programs often fail when users do not understand value distribution. Stories allow teams to explain the mechanics at a human, digestible pace.

What France Demonstrates

France treats stories as a guided, editorialised UX layer. This layer supports:

- complex categories that need narrative

- structured inspiration

- transparent communication for loyalty and service value

- stable reading behaviour across multi-slide journeys

- deeper understanding before action

This approach shows that stories can function as an internal navigation tool inside retail apps, complementing catalog structures and reducing user effort at early decision stages.

Poland: A Performance-Driven Market With Fast Decision Cycles

Poland demonstrates how stories behave in a market where users respond quickly to transparent value. The country relies heavily on promotional mechanics, clear spending thresholds and concise product framing. This creates a different relationship with the format.

Stories are not a place for narrative or contemplation. They serve as a high-velocity dispatch point: short, direct, and commercially efficient.

Polish stories follow a compressed rhythm:

- Slide 1 — Immediate value

Cashback amount, discount, or clear promotional incentive. Often the highest CTR point across the entire sequence. - Slide 2 — Category or item focus

A single product or clearly defined category segment. - Slide 3 — Secondary offers or relevance extension

Another product from the same category or a variation with different spending thresholds. - Slide 4 — Short CTA

“See more”, “Get coupon”, “Check details”, with no narrative framing.

Three to four slides are the norm. The format gives no room for hesitations; each frame must deliver value instantly.

Black Weeks

Black Weeks reveals a friction that commonly exists in retail apps: promotions scattered across different UI surfaces dilute visibility. Stories solve this by concentrating high-value offers into a consistent entry point that users learn to check regularly. For value-driven markets, this becomes a reliable behavioural loop.

.jpg?2025-12-02T15:41:28.967Z)

Key metrics:

- CTR: 1%–9%

with the highest peaks at 9% on multiple days - Read rate: 28%–78%

most commonly between 30% and 43%

(the 78% value appears on a low-impression day) - Post-read CTR: 4%–9%

- Slide count: 3–4 slides

This confirms that for promotion-heavy markets, stories serve as an extremely efficient focal point, outperforming banners or static sections of the app.

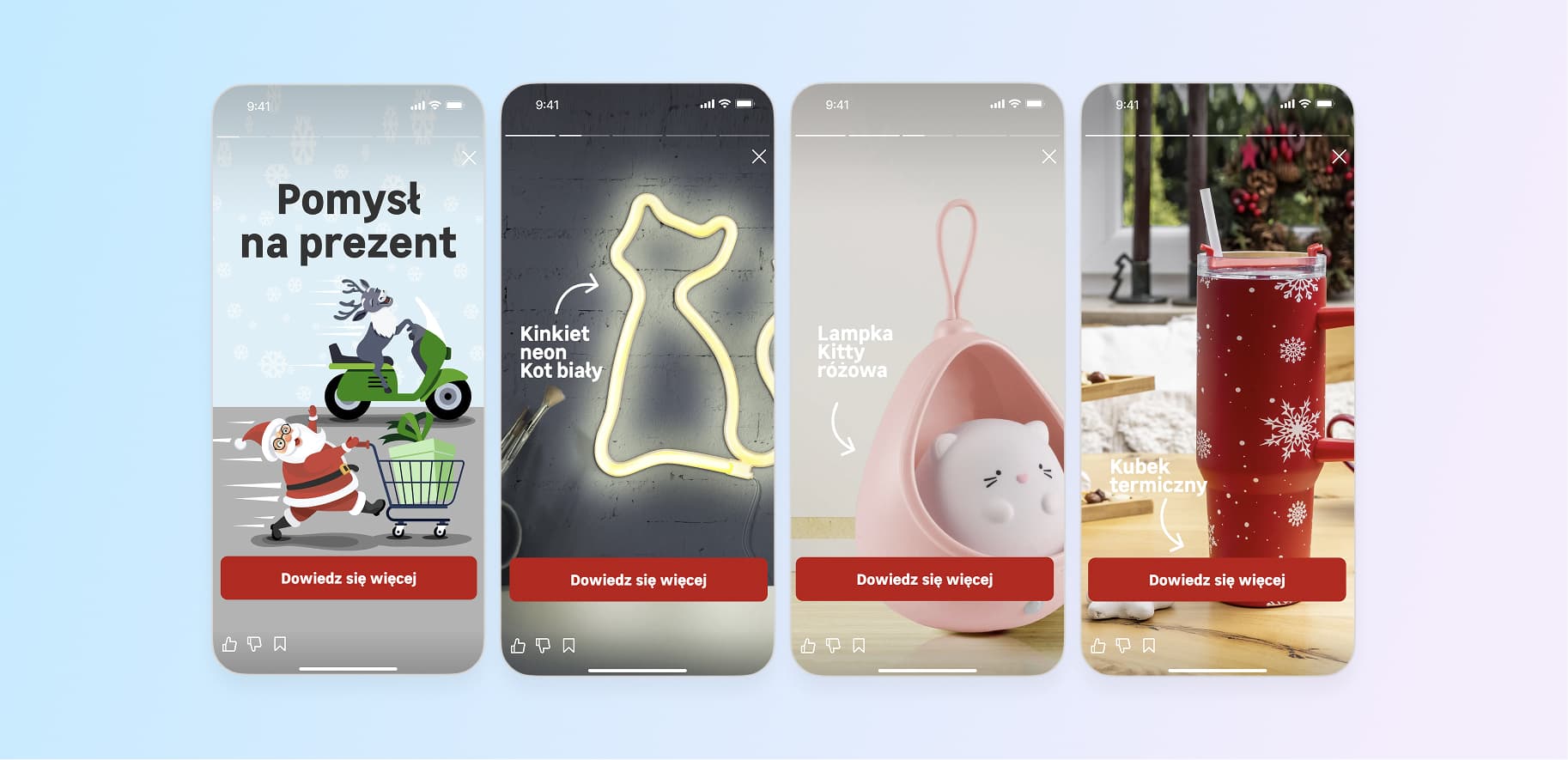

Gift Ideas

Gift Ideas stories follow a different behavioural logic from Black Weeks. Instead of economic clarity, they rely on visual novelty and impulse triggers. Products with strong emotional appeal — novelty lamps, decorative items, seasonal gifts — produce the highest engagement.

Key metrics:

- CTR: 1.6%–6.3%

with peaks driven by visually distinctive items - Read rate: 22%–48%

reflecting intentional skimming and early clicks - Post-read CTR: 3%–7%

- Slide count: 3–4 slides

E-commerce interpretation: Gift Ideas shows that stories can compress the impulse discovery journey into a few taps. Item-level novelty gets lost inside large category grids. Stories create a clean micro-environment where a standout SKU can command disproportionate attention. This plays directly into the psychology of gifting and seasonal browsing.

What Poland Demonstrates

Poland illustrates the role of stories as a tactical engine inside a promo-driven e-commerce environment.

The format enables:

- rapid filtering of promotional value

- higher CTR compared to other markets

- predictable engagement on short sequences

- clean separation between impulse and value-driven behaviours

- reduced dependence on deep navigation during retail events

In this market, the story format optimises the commercial surface. It compresses the journey from impression to action and aligns perfectly with the behavioural logic of a fast, price-sensitive audience.

Italy: Seasonal Commerce Delivered Through High-Intent Story Series

Italy activated a focused seasonal module built around holiday decor and impulse gifting.

Compared to France’s service-led content and Poland’s hybrid of loyalty mechanics and product discovery, Italy leaned on a pure e-commerce play: a promotional story funnel designed to convert browsing users into active shoppers.

Decora La Tua Casa

.jpg?2025-12-02T15:47:57.593Z)

Key metrics:

- Overall CTR from impressions to opens: 3.5 %

Daily CTR range: 2.6–5.0 % - Average reading conversion from opens: 48 %

- Average click conversion from opens: 17.4 %

Daily click conversion range: 7.3–30.2 %

From a product perspective, Italy’s campaign shows how a single, well-structured story can support an entire seasonal category. Instead of building multiple banners for each SKU, the team uses one reusable frame that sends traffic into a curated catalog.

Cross-Market Insights

Across France, Poland, and Italy, the data reveals a consistent pattern: stories act as a multi-purpose engagement layer that adapts to each retail team’s priorities. Despite different markets and content themes, several behavioural trends repeat themselves.

1. Stories work as a high-intent browsing surface

Average reading depth across the three markets stays within 46–58%, even when the format extends to 8 slides. This suggests a stable willingness to swipe through structured retail content when it feels editorial rather than pushy.

This is especially visible in France, where inspiration and service stories collect 40–70% reading conversion, proving that non-promo content can hold attention and move users into problem-solving mode (“how to renovate”, “what to install”, “what colours work together”) before a purchase is even considered.

2. Promotional stories convert best when the value is immediate and clear

Poland shows the sharpest correlation between clarity of offer and click behaviour.

The Black Weeks campaign, with bold price framing, produced CTR peaks of 7.08% in narrower segments, which is the highest in the dataset.

Italy’s decor promotions, though more visual and less aggressive, still maintain a 3.3–5.0% CTR range on a broad audience and 17–30% click conversion among readers.

3. Stories help merchandise wide assortments without overwhelming users

Users still swipe through most slides, because each publication follows a predictable, low-cognitive-load structure: value → product → supportive visuals → CTA.

This format lets retailers surface multiple SKUs or service bundles without creating banner fatigue or cluttering the home screen. Stories act as a rotating “micro-catalog” that remains native to the mobile experience.

4. Market maturity influences click behaviour, not reading depth

Reading behaviour is stable across France, Poland, Italy. Click behaviour varies more sharply:

- France: strong reading, moderate clicks

- Poland: strong reading, aggressive click spikes on price messaging

- Italy: stable reading, consistent mid-range click volume

This pattern suggests that interest (reading) is universal, but action (click) depends heavily on merchandising strategy, perceived price competitiveness, and alignment with seasonal cycles.

Conclusion

Across all three markets, stories have become a reliable multi-use engagement layer that strengthens the retail app without adding complexity. They help teams merchandise large assortments, educate users, support seasonal cycles, and convert high-intent shoppers — all within a format that feels native to mobile browsing.

.jpg?2025-12-03T08:14:09.422Z)

Want this in your app?

InAppStory helps teams launch in-app messages, stories, banners, and gamified flows that drive feature adoption, LTV, and conversion — all from one dashboard.

Read also

.jpg?2025-12-03T08:05:51.798Z)

.jpg?2025-09-25T13:19:08.029Z)

.jpg?2025-09-25T13:40:14.027Z)

.jpg?2025-09-18T15:25:21.897Z)

.jpg?2025-09-26T13:50:32.013Z)