.jpg?2026-02-17T14:47:30.411Z)

When Leroy Merlin ran out of hands, InAppStory became the extra ones

.jpg?2025-12-04T15:03:42.006Z)

.jpg?2025-12-04T15:04:00.165Z)

.jpg?2025-12-04T15:04:17.472Z)

How BSPB Reached 1.2M Users with Stories

Karina

Author @ InAppStory

TL;DR

BSPB used in-app stories to explain complex products, build trust in a competitive market, and keep customers engaged over time. Deposit campaigns became the strongest driver of clicks, with nearly 1 in 5 readers moving to product pages. Quizzes introduced a playful angle, reaching over 188,000 users in three days and converting 10% of readers into actions. Functional updates proved highly efficient, turning a single-slide announcement into 40–53% click-through rates. Onboarding stories secured 1.2M guaranteed opens and converted 71% of engaged readers. Together, these formats showed that financial communication can be both clear and measurable inside a banking app.

What Was the Challenge?

BSPB faced three common hurdles for banks working in digital.

The first was education. Financial products like deposits, credits, or investments are often complex. Customers need explanations that are simple, visual, and easy to act on inside a mobile app.

The second was trust. In a market where many users already have strong relationships with other banks, it is difficult to stand out. BSPB had to prove reliability and show value in a way that felt clear and transparent.

The third was engagement over time. A one-off campaign can capture attention, but sustaining it is harder. The bank needed a format that would stay fresh, combine product communication with cultural moments, and motivate customers to return regularly.

How BSPB Used Stories

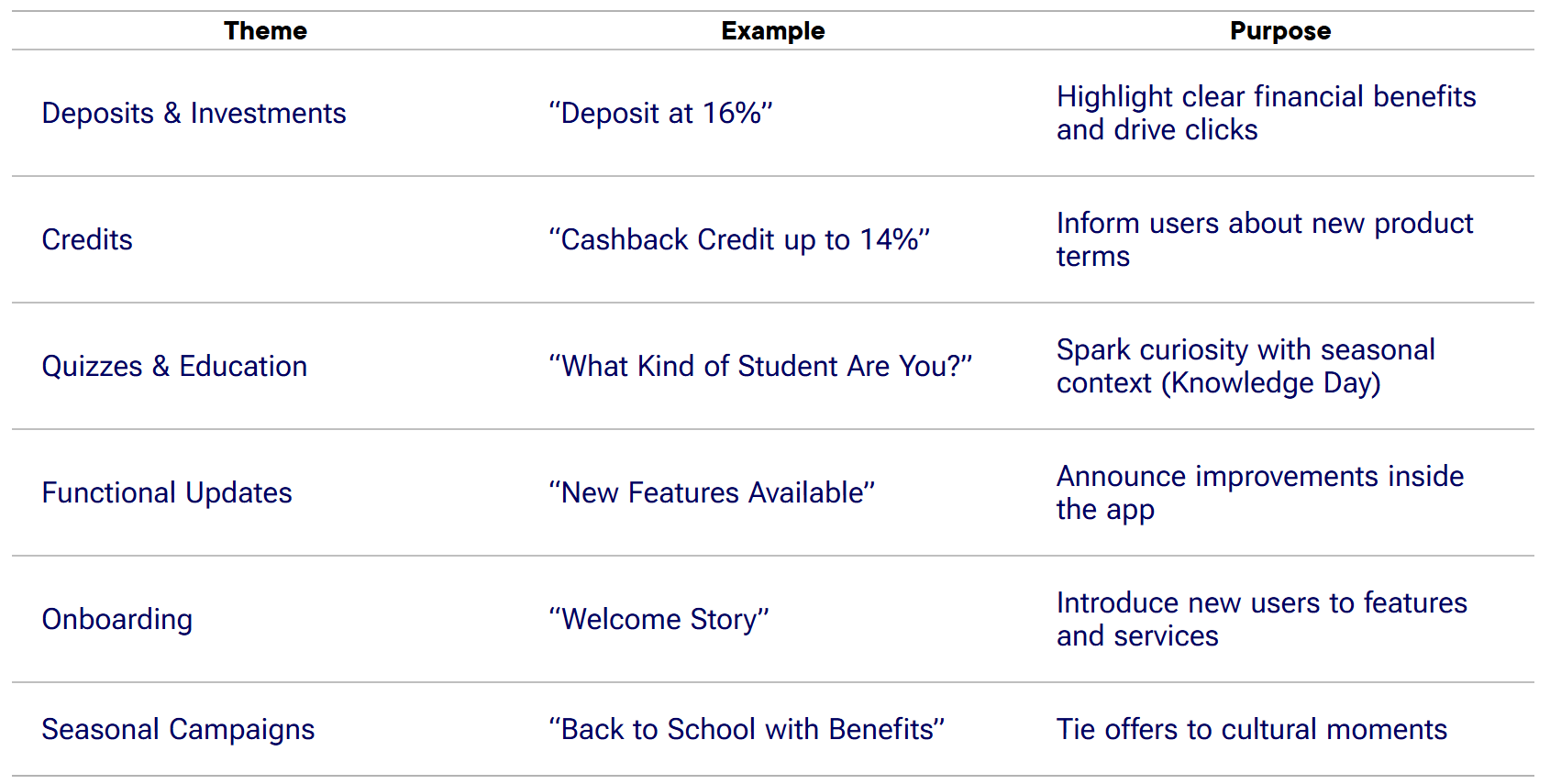

BSPB launched a mix of story formats, each matched to a different business goal:

Several of these were designed together with the InAppStory creative team. As in the Hamkorbank onboarding project, creative support helped tailor the content to product priorities making stories more engaging and relevant.

Results by Theme

Deposits & Investments

Deposit campaigns achieved the strongest click results. Stories like “Deposit at 16%” reached over 1M impressions, converted 81% of opens into reads, and drove 55,000 clicks. These campaigns proved that clear financial benefits directly presented inside stories motivate users to act.

Credits

Credit offers like “Cashback Credit up to 14%” maintained nearly 100% open-to-read conversion and delivered steady click-through in the 4–6% range. By keeping the message short and product-focused, BSPB managed to integrate credit communication into daily app use.

Quizzes and Educational Campaigns

The seasonal quiz “What Kind of Student Are You?” attracted 188,000 impressions on the first day. While CTR was modest, engaged users showed 84% read conversion and 10% click conversion. This format demonstrated that playful, contextual content can build deeper engagement and turn attention into actions.

.webp?2025-10-06T12:52:10.064Z)

Functional Updates

Utility-driven announcements were short but powerful. A one-slide Story “New Features Available” reached around 1,000 users daily and achieved 40–53% click conversion rates. Even basic app updates became moments of measurable interaction.

.webp?2025-10-06T12:52:47.080Z)

Onboarding

The “Welcome Story” generated 1.2M opens automatically, as it was shown to every new customer. Of these, 197,000 reads were recorded, and 71% of engaged readers clicked forward. This confirmed onboarding as both an educational and conversion-driving channel.

.webp?2025-10-06T12:53:24.400Z)

Seasonal Campaigns

Campaigns like “Back to School with Benefits” reached hundreds of thousands of users and strengthened the connection between financial products and cultural moments. They supported brand relevance and kept users engaged beyond purely transactional offers.

Why It Worked

1. Clarity in numbers

Stories with precise figures converted better than generic slogans.

.webp?2025-10-06T12:53:55.279Z)

2. Format variety

BSPB combined product-heavy campaigns with quizzes, functional updates, and seasonal content. This variety kept engagement high over time.

.webp?2025-10-06T12:54:30.985Z)

3. Creative expertise

With InAppStory’s creative studio involved, several campaigns were adapted to the bank’s tone and product priorities.

4. Balanced funnel

Onboarding and functional updates secured guaranteed reach. Deposit offers and quizzes converted engagement into clicks. Together, they built a full funnel from awareness to measurable action.

Conclusion

For BSPB, Stories became more than a way to push promotions. They worked as a proof layer inside the mobile app, where users could see value at the exact moment of decision. Deposit campaigns brought tens of thousands of product clicks.

Quizzes turned seasonal moments into playful engagement. Functional updates and onboarding ensured every customer saw and acted on key messages.

The result is clear: with stories, BSPB turned everyday banking communication into an interactive cycle of attention, action, and trust.

Want this in your app?

InAppStory helps teams launch in-app messages, stories, banners, and gamified flows that drive feature adoption, LTV, and conversion — all from one dashboard.

Read also

.jpg?2025-09-18T15:55:42.347Z)

.jpg?2025-09-25T11:34:26.996Z)

.jpg?2025-09-18T16:34:42.986Z)