Securing the Future: How Mobile App Stories Help Fintech Companies Educate Users

In a world where digital transactions reign supreme, ensuring the safety of our hard-earned money and sensitive information has become a top priority. As fintech companies continue to revolutionize the way we manage our finances, the need for robust cybersecurity measures and fraud prevention strategies has never been more critical. But let's face it, the realm of online security can sometimes feel like navigating a maze filled with cunning cybercriminals and perplexing jargon.

Fear not, dear readers, for there is a beacon of hope amidst the sea of uncertainties—mobile app stories. Yes, you heard that right! These virtual narratives, hidden within the depths of our trusted financial apps, have emerged as powerful tools for educating users on the ever-evolving landscape of cybersecurity and fraud prevention. It's like having a tech-savvy guardian angel who protects us from the perils of the digital realm, all while regaling us with captivating content. Who said learning about online security had to be dull and uninspiring?

Now, before we dive headfirst into this fascinating subject, let us sprinkle some statistics to pique your interest. Did you know that cybercrime is projected to cause a mind-boggling $10.5 trillion in damages by 2025? People need to remember that knowledge is power, and arming ourselves with the right information is our best defense against these digital miscreants.

So as we venture further into the realm of mobile app stories and their invaluable role in educating users on cybersecurity and fraud prevention, remember this: securing the future of our digital lives is not just a matter of necessity—it's an opportunity to arm ourselves with knowledge, defeat the cyber villains, and pave the way for a safer, more resilient tomorrow.

Understanding the Threat Landscape

In order to navigate the world of fintech and protect users from potential harm, it is vital to have a comprehensive understanding of the threat landscape. Here, we outline the various cybersecurity threats faced by fintech companies and their customers, along with the common fraud schemes and scams targeting the financial services industry:

Cybersecurity Threats

Phishing scams: Deceptive emails and messages that impersonate legitimate entities, such as banks or financial institutions, to trick individuals into revealing sensitive information like usernames, passwords, or credit card details. These scams often employ sophisticated tactics, such as creating fake websites that resemble genuine ones, aiming to deceive users into providing their personal data unwittingly. Phishing attacks can lead to identity theft, financial loss, and unauthorized access to accounts.

Malware: Malicious software, including viruses, worms, and ransomware, that infiltrates devices, networks, or systems with the intention of compromising their security and extracting valuable data. Malware can be delivered through infected email attachments, compromised websites, or software vulnerabilities. Once inside a device or network, it can perform various malicious activities, such as stealing sensitive information, monitoring user activities, or encrypting data and demanding ransom payments for its release. Malware attacks can result in data breaches, financial damage, and disruption of normal operations.

Data breaches: Unauthorized access or exposure of sensitive or confidential information, often as a result of a cyberattack or security vulnerability. Data breaches can occur through various means, such as hacking into databases, exploiting weak credentials, or social engineering techniques. The compromised data can include personal information, financial records, or intellectual property. The consequences of data breaches can be severe, including financial losses, reputational damage, and legal implications.

Romance scams: These heartless schemes prey on individuals seeking companionship or romantic connections online. Fraudsters create fake profiles on dating websites or social media platforms, establishing emotional relationships with their victims. They gradually manipulate their victims into sending money or providing personal and financial information under the guise of various reasons, such as emergency situations or travel expenses. Romance scams can result in significant financial losses, emotional distress, and even identity theft. It is important to exercise caution when interacting with individuals online, avoid sharing sensitive information with strangers, and report any suspicious behavior to the relevant authorities.

Telephone scams: Fraudsters often pose as representatives from legitimate financial institutions or government agencies, using social engineering techniques to deceive victims over the phone. They may employ scare tactics, such as threats of legal action or account closures, to coerce individuals into providing sensitive information, making payments, or transferring funds. These scams exploit trust and authority to manipulate victims into divulging confidential data or falling victim to financial fraud. It is crucial to exercise caution when receiving unsolicited calls, verify the identity of the caller independently, and refrain from sharing sensitive information or making financial transactions over the phone.

To protect against these fraud schemes and scams, individuals should be vigilant, skeptical, and educated about common tactics employed by fraudsters. They should be cautious when sharing personal information, verify the authenticity of requests before taking action, and report any suspicious activities or encounters to the appropriate authorities or financial institutions.

By comprehending these threats, individuals and fintech companies can proactively protect themselves and their customers. Knowledge serves as the strongest defense against cyber threats, enabling the development of effective countermeasures and the implementation of robust security practices.

Now we will explore how mobile app stories act as powerful educational tools, empowering users with the necessary knowledge to navigate the complex realm of cybersecurity and fraud prevention.

The power of mobile stories

Mobile app stories are a popular feature found in many social media and messaging platforms, where users can create and share temporary photo or video content that disappears after a certain period of time. These stories typically appear in a separate section of the app and are displayed in a chronological order. Users can view these stories by tapping on the profile pictures or usernames of the accounts they follow.

So, how exactly do mobile app stories play a crucial role in fortifying our digital fortresses? Well, stories have an uncanny ability to captivate our attention and embed important information deep within our subconscious minds. By presenting cybersecurity and fraud prevention concepts through engaging narratives, fintech companies can effectively convey complex ideas without overwhelming their users with technical jargon.

These stories weave compound vocabulary into digestible narratives, effortlessly guiding us through the labyrinth of online threats. Suddenly, terms like encryption, malware, and biometric authentication become as familiar as ordering your favorite pizza toppings. Okay, maybe not that familiar, but you get the idea!

When it comes to educating users on cybersecurity and fraud prevention, mobile app stories can be an effective tool for several reasons:

- Bite-sized content: Stories are designed to be short and concise, with a limited duration for each piece of content. This format allows for quick and easily consumable information, making it ideal for educating users on important security practices without excessive details.

- Effective Communication of Updates: Fintech companies often introduce new features, policy changes, or updates to their services. In-app stories offer a convenient and attention-grabbing platform to communicate such information. By delivering updates through stories, companies can ensure that users are well-informed about the changes, reducing confusion and enhancing user experience.

- Educating Users on Financial Literacy: Fintech companies have an opportunity to utilize in-app stories to educate users on financial literacy. Stories can cover a wide range of topics, including budgeting, investment strategies, debt management, and fraud prevention. By providing valuable educational content in a visually appealing format, companies can empower users to make informed financial decisions and improve their financial well-being.

- Building Trust and Transparency: In-app stories provide an opportunity for fintech companies to establish trust and transparency with their users. By sharing stories that highlight security measures, privacy practices, and the steps taken to protect user data, companies can reinforce their commitment to safeguarding user information. This fosters trust among users and reinforces the company's credibility.

- Personalized User Experience: In-app stories can be tailored to specific user segments, allowing companies to deliver personalized content and recommendations. By analyzing user preferences, transaction history, or financial goals, fintech companies can create customized stories that address the individual needs and interests of their users. This personalization enhances user satisfaction and strengthens the relationship between the company and its customers.

If you want to dive even further beyond these milestones, we highly suggest to look at the FREE fintech report that our experts have prepared for you. Learn how to optimize the onboarding process, meet user needs with personalized recommendations and implement effective Stories methods to supercharge your customer engagement.

Best Practices for Developing Mobile App Stories

Crafting compelling and effective mobile app stories is an art form that requires careful consideration and attention to detail. To truly make an impact, fintech companies must adhere to best practices when developing mobile app stories. By understanding the nuances of storytelling, utilizing creative techniques, and implementing user-centric strategies, companies can ensure their stories resonate with users, effectively communicate key messages, and ultimately drive positive outcomes.

To create more compelling and effective mobile app stories, fintech companies can consider the following tips:

- Define Clear Objectives: Determine the specific goals you want to achieve with your mobile app stories. Whether it's educating users about cybersecurity best practices, promoting fraud prevention measures, or announcing updates, having a clear objective will help you tailor your stories to meet those goals effectively.

- Keep it Concise and Engaging: Mobile app stories are designed for quick consumption, so keep your content concise and engaging. Use eye-catching visuals, compelling headlines, and concise text to grab users' attention and deliver key messages effectively within the limited time frame.

- Use Storytelling Techniques: Tell a story with your mobile app stories to make them more relatable and memorable. Create a narrative that takes users through a problem-solution journey or highlights real-life examples. This storytelling approach helps users connect emotionally with the content and better understand the importance of cybersecurity and fraud prevention.

- Incorporate Interactive Elements: Leverage the interactive features available in mobile app stories to enhance user engagement. Include interactive quizzes, polls, or swipeable elements that encourage users to participate and test their knowledge. This fosters active engagement and boosts information retention.

- Provide Practical Tips and Advice: Offer practical and actionable tips in your mobile app stories. Break down complex cybersecurity concepts or fraud prevention measures into simple steps that users can implement immediately. Focus on providing value and empowering users to take proactive measures to protect themselves.

- Showcase Success Stories: Share success stories or testimonials from users who have benefited from your cybersecurity practices or fraud prevention measures. This helps build trust and demonstrates the effectiveness of your strategies. Users are more likely to adopt secure practices when they see real-life examples of how it has protected others.

- Align with Brand Identity: Ensure that your mobile app stories align with your fintech company's brand identity and values. Maintain consistent visual aesthetics, tone of voice, and messaging that reflect your brand's personality. This helps reinforce brand recognition and strengthens the overall user experience.

Creating visually appealing and engaging in-app stories is only part of the equation. It's equally important for fintech companies to strategically integrate these stories into their overall cybersecurity strategy. While a beautiful story can capture attention, it is through strategic alignment that its true impact is realized.

- Consistency with Messaging: Ensure that the content shared through mobile app stories aligns with your overall messaging around cybersecurity and fraud prevention. Stories should reinforce and complement the messages communicated through other channels, such as your website, social media, or email campaigns.

- Reinforce Key Security Practices: Use mobile app stories to emphasize essential security practices, such as strong password management, two-factor authentication, and safe browsing habits. Repetition and reinforcement of these practices through stories can help ingrain them in users' behavior and enhance their security awareness.

- Timely Updates and Alerts: Utilize mobile app stories to communicate timely updates, alerts, or notifications related to cybersecurity threats or emerging fraud techniques. This ensures that users are promptly informed about potential risks and can take necessary precautions.

- Integration with Support and Reporting Channels: Ensure that your mobile app stories provide clear instructions on how users can report any suspicious activities, fraudulent transactions, or security concerns. Include links or buttons to relevant support channels within the stories to facilitate immediate action.

- Measure and Iterate: Monitor the performance of your mobile app stories by tracking engagement metrics, such as views, interactions, and user feedback. Analyze the data to understand which stories are resonating well with your users and iterate on your content strategy accordingly.

By implementing these tips and integrating mobile app stories thoughtfully into your overall strategy, fintech companies can effectively engage users, reinforce cybersecurity practices, and promote fraud prevention measures, ultimately enhancing the security and trustworthiness of their platforms.

Examples of Stories in FinTech Apps

Revolut

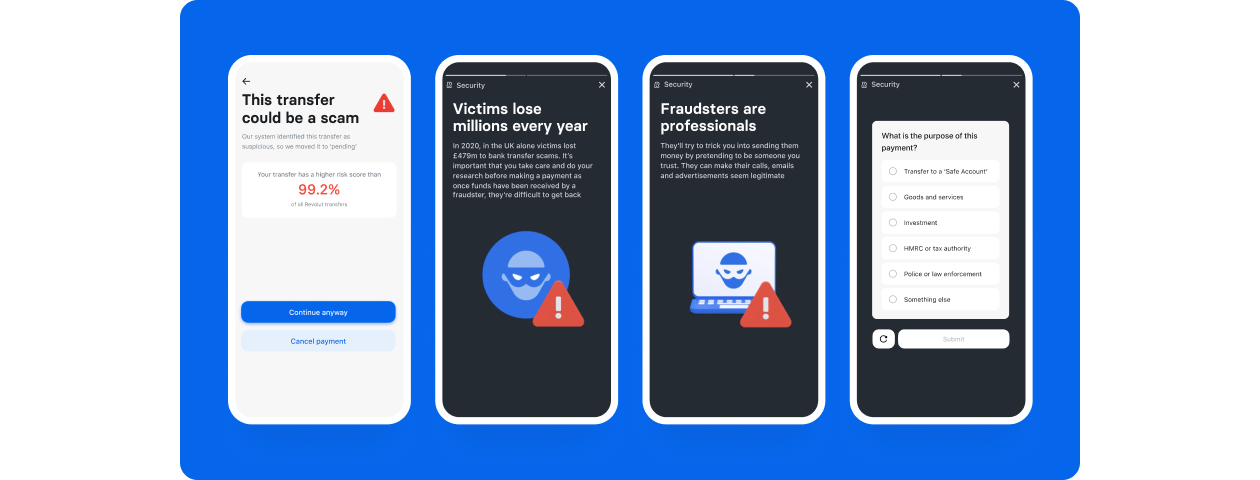

Revolut has recently implemented security enhancements to improve the accuracy of their fraud warnings and enhance their communication with customers. Taking user feedback into account, they have made their alerts more specific and informative, ensuring that customers have the right data and understanding to combat fraud effectively.

One of the key improvements is the refinement of their machine learning models, which now assign a risk score to each payment. When this score exceeds a certain threshold, the model triggers different customer flows to deliver effective warnings and prevent fraudulent transactions. This advanced system helps identify potential risks and provides timely alerts to users, empowering them to take action against fraudsters.

In addition to these enhancements, Revolut has introduced a series of educational stories within the app. These stories are displayed when customers attempt to make payments to accounts that have been flagged as suspicious. The stories serve as a crash course in scam-awareness, providing valuable insights and guidance to users. They are tailored to the purpose of the transaction, offering specific information that helps customers make well-informed decisions.

It's worth noting that these educational stories are designed to be comprehensive and impactful, and they cannot be skipped by users. Revolut encourages customers to read through the stories to ensure they have a thorough understanding of potential scams and how to protect themselves from fraud.

With these security enhancements, including the risk scoring system and the educational stories, Revolut aims to empower its customers with the knowledge and tools necessary to detect and prevent fraud. By combining advanced technology with informative content, Revolut is dedicated to creating a safe and secure financial environment for its users.

Fi money

Fi Money utilizes in-app stories as an effective educational tool to impart knowledge on a wide range of financial topics. These stories, characterized by their brevity, engagement, and simplicity, serve as an excellent medium for users to gain insights into various aspects of money management.

Within Fi Money's in-app stories, users can explore an array of subjects, including setting financial goals, effectively tracking spending habits, implementing money-saving strategies, making informed investment decisions, and safeguarding finances against fraudulent activities. These stories serve as a valuable resource for individuals seeking to enhance their understanding of personal finance.

Accessible and user-friendly, Fi Money's in-app stories provide a convenient avenue for users to acquire knowledge and insights that can inform and improve their financial decision-making. Whether you are new to financial management or seeking to refine your existing practices, these stories offer valuable information that can empower you to make more informed choices when it comes to your money.

Conclusion

In the realm of fintech, where digital transactions are prevalent, educating users on cybersecurity and fraud prevention is of utmost importance. With the rise of cyber threats and sophisticated fraud schemes, it is crucial for individuals to be well-informed and equipped with the knowledge to protect themselves and their finances.

Overall, the role of mobile app stories in educating users on cybersecurity and fraud prevention is invaluable. By utilizing the power of storytelling, fintech companies can bridge the knowledge gap, raise awareness, and empower their users to make informed decisions in the digital realm. With the continued advancement of technology and the ever-evolving nature of cyber threats, investing in user education through mobile app stories is a proactive step towards building a safer and more secure fintech ecosystem.